In late October I had the opportunity speak about how early retirement is more achievable than you might think, provided you take appropriate actions and make wise financial choices. Specifically, on slide 28, I provided a simple example of how healthy spending and savings patterns can open up many life choices. You could stop work entirely, or travel the world, or fight for injustice. The choice is yours.

In late October I had the opportunity speak about how early retirement is more achievable than you might think, provided you take appropriate actions and make wise financial choices. Specifically, on slide 28, I provided a simple example of how healthy spending and savings patterns can open up many life choices. You could stop work entirely, or travel the world, or fight for injustice. The choice is yours.

This week, I would like to build on this concept of healthy spending and saving. And there’s a pretty simple calculation that serves as a good measuring stick of your overall current and future financial health: Your savings rate.

Why Your Savings Rate is Important

Your savings rate is a major factor in determining how fast you are accelerating your net worth, building emergency savings, establishing your pot of “FU Money” (that’s “Fun Unlimited”… right?), and moving deeper into the land of choice. In other words, your savings rate is like the speedometer in your car, showing you how quickly you are moving towards your desired destination. Without this information, how will you know if you’re on the right track?

As a side note, as your net worth climbs higher, you will start to notice that your investment returns have more impact on your net worth than your savings rate, but in the early days, it’s all about the savings rate.

And for further reading on why it’s important to calculate your savings rate, check out Mr. Money Mustache’s article on the shockingly simple math behind early retirement.

Basically, there’s a direct and exponentially-beneficial connection between your savings rate and your ability to retire early (or do anything else with that money). If you’re just starting out, absolutely be sure to hit at least 10%. This should secure you a comfortable, normal-age retirement. But if you want additional choices, then you should be targeting something in the 40% – 60% range. I personally know people who are rocking the 70% – 80% range!

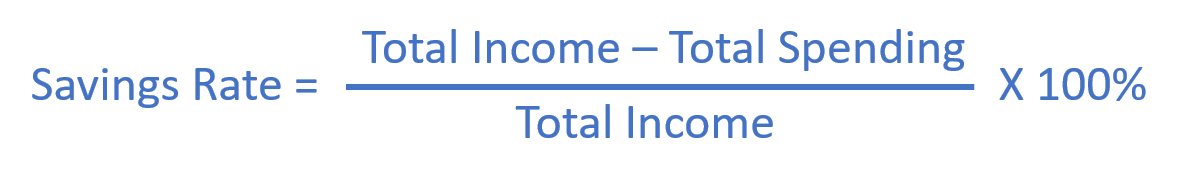

So just how do you calculate your savings rate, anyway?

How to Calculate Your Savings Rate

The basic equation for calculating your savings rate is:

*** or ***

You can do this for any period of time you choose, but annual is probably the most common. Because I can be impatient at times, I actually calculate our annual savings rate each month. In other words, we have a “moving 12-month average” savings rate. You just redo the calculation each month using the last 12 months’ worth of data. But you don’t need to do that if you don’t want to.

Every month I also calculate our total cumulative savings rate since we got married in 2005 (i.e. a 13-year total savings rate). It doesn’t matter what time period you choose, as long as you start somewhere to get a picture of your situation.

Furthermore, you could choose to do this with before-tax dollars or after-tax dollars. I choose after-tax dollars because it’s easier for me. However, using before-tax dollars would technically be more accurate because your tax bill is an expense that you do have at least some control over with RRSPs, charitable donations, province of residence, etc. But again, like the duration you pick, it doesn’t really matter at this point whether or not you include your tax bill; just get started!

So how do you calculate Total Savings and Total Income? I’ll start with income, since it’s easier.

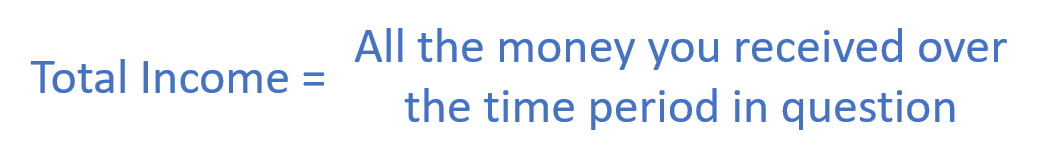

Calculate Total Income

“All money” includes your pay (before or after tax, as mentioned above), any tax refunds you received, government benefits, birthday money, bank account interest, etc. The nice thing here is that most of that is easily available electronically going back a year. Just add them all up, and take a reasonable guess for ones you’re not sure of. (Did Uncle Bob give me $100 or $1000 for Christmas last year…?)

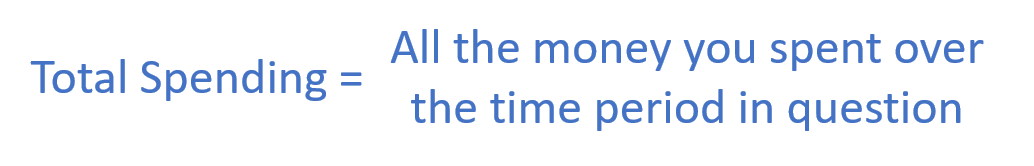

Calculate Total Savings

Total Savings is a little trickier, but the concept is the same. It’s Total Income minus Total Spending. Since you’re already figured out your income, you’re half-way there!

*** and ***

I personally track my monthly spending with far more detail than most people would ever consider normal. For example, I previously revealed our monthly grocery bills going all the way back to 2006. But for today’s purpose, you just need to know how much you’re spending, not what you’re spending it on. (Although learning the what will help you improve and optimize, so keep that in mind.)

If you’re just looking for a total of your spending, without the details, you probably already have most of that available electronically, too. So go back through your bank account(s) and just add up all of the money that left your account. If you carry a balance on your credit cards instead of paying them off each month, then go through them, too, and add up everything that gets charged. And if you use cash a lot, you’ll need to estimate that, too. But I have a special trick there.

Special trick for tracking your cash expenses: Don’t!

Instead, whenever you take cash out of the bank machine, consider it as an expense at the time of withdrawal, not when you actually spend the cash. Then you don’t need to worry about tracking the little tiny cash purchases. If you receive a cash gift or make a Kijiji sale, record it as income when it goes back into your bank account. And if it never goes in, then it’s both an income and an expense (because it’s like you put it in your bank and then took it right out again.)

What Next?

If you’re not happy with your savings rate, then you should take some big steps to reduce your expenses; it’s usually easier to do that than to increase your income. Probably the easiest and fastest way to cuts costs is to revisit your vehicle purchase. For example, back in the talk last month I touched on the 10% rule of car ownership. Or you could more accurately calculate your total cost of ownership with these steps.

If you’d like to discuss your savings rate in more detail, or have questions about your specific situation, drop me a line; I’d love to help.

Your Turn Now!

Your Turn Now!

How are you doing with your savings rate? Do you calculate it routinely, and are you happy with the result? Any tips or suggestions to make the process easier?

Your Turn Now!

Your Turn Now!

Chris, do you include dividends and tax refunds in you income total?

Hi Bob,

I do not include dividends because they remain in my investment accounts and are reinvested (automatically in my registered accounts, and manually in my non-reg accounts). When I withdraw from those accounts, I include the full withdrawals as “negative” savings. I suppose I could consider them as income instead, which would have the effect of boosting my savings rate.

Consider the following simple example:

Assume 100k income, 50k savings deposits, 20k withdrawals.

Method A (mine): (50-20) / 100 = 30%

Method B: 50 / (100+20) = 42%

I include tax refunds as straight-up income. That’s because I use my after-tax income, not my gross income. It’s just easier to figure out that way, although it has the effect of inflating my savings rate.

In both cases, it doesn’t really matter which way you go, as long as you’re consistent.

Also, I need to apologize: I’ve been having trouble with the auto-notification for comments, so I didn’t notice your comment until just now. Sorry for the delayed response. I’ll try and keep a closer eye on it!

Chris

Many thanks for explaining your method. I’ll use method A, which puts us at a savings rate of 59%. On top of that we have some employer matching plus dividends and interest.

That’s awesome, Bob! Thanks for sharing.